Pandas Weekly Newsletter

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

Market Big Picture & Long-Term Technicals

$SPX saw yet another large rejection at weekly trendline resistance, selling off over 100pts from the highs. This go around bulls stepped in at key 3900 support after briefing undercutting it and recapturing it and rallying into the end of the week. Earnings season is fully underway now + FOMC is next Wednesday. We’re positioned to see a rally over 4000 if earnings are better than expected and risk is taken off into FOMC.

Here are a couple highlights that sum up my market big picture.

$VIX breaking down under 20

Rotation back into mega caps / growth

Change in character, dips bought for more than 1 day

Economic Calendar & Earnings

source: (investing.com)

Notable Earnings: MSFT 0.00%↑ BA 0.00%↑ TSLA 0.00%↑ CVX 0.00%↑

source: earningswhispers.com

Near Term Outlook & Trade Plan

If the market continues to see dips bought, we are set up for another 4000 test and stronger leg higher. Between 3950-4000 can prove to be a tricky range if price digests the dip buy from last week. Under 3950 begins favoring a back test of 3919 where bulls would want no lower and print another higher low. This would be a welcomed “check back” in my opinion. If SPX can rally over 4000 coupled with strong earnings this week, we can see 4050-4100 quickly.

SPX 4000 targets 4015, 4053

SPX 3950-4000 = chop zone

SPX 3950 targets 3919, 3900

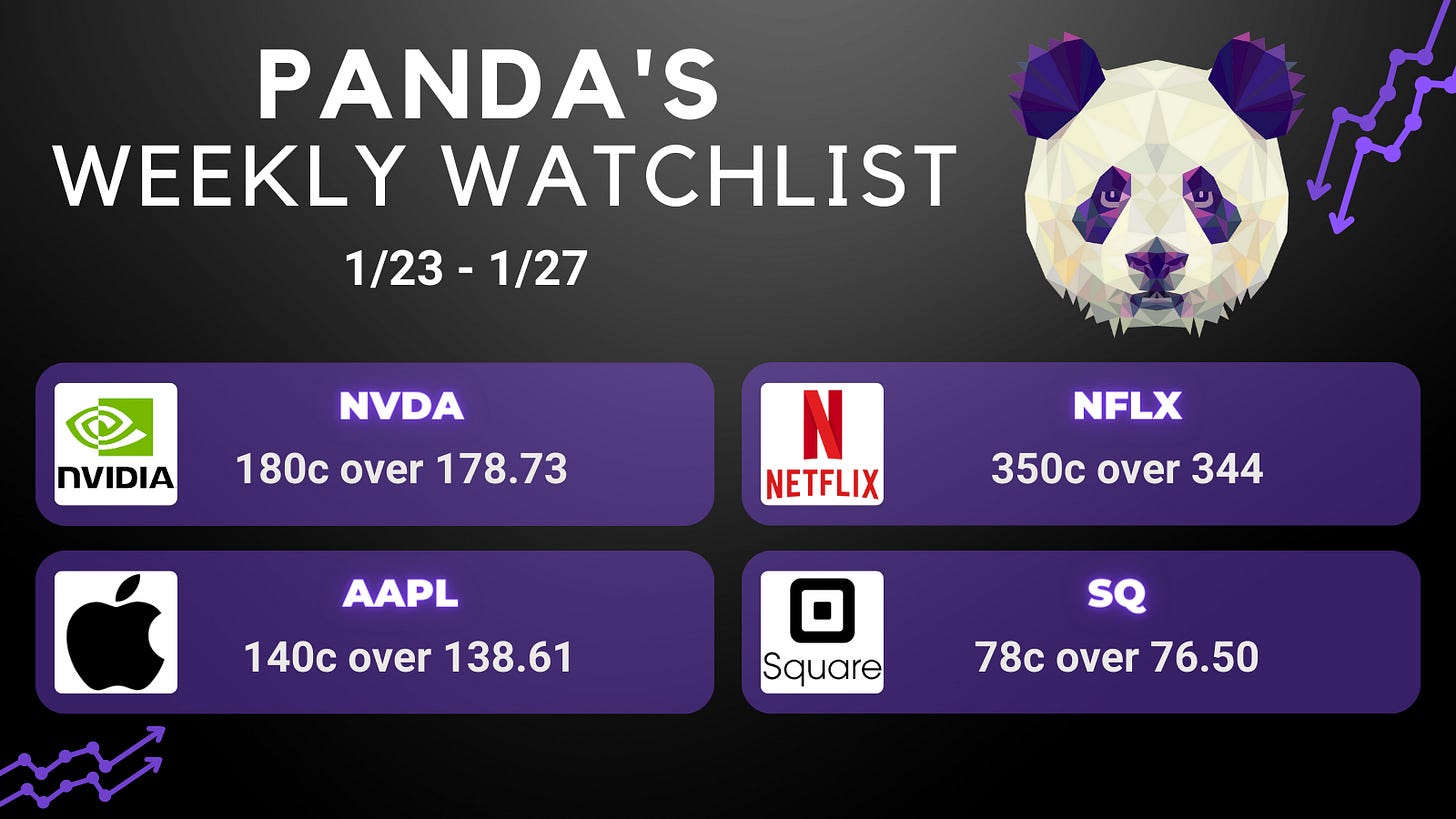

Pandas Weekly Watchlist

Our Favorite Trade Setup - SQ over 76.50

Contract: SQ 1/27 78c

Targets: 78, 79.90, 82.66

Stop: 74.30

Notes: SQ has broken a long-term trend when you zoom out and has based nicely since breaking trend. It’s now looking setup for a move higher if it can break over 76.50. Possible to see 82.66 level next.

Join our Discord!

We provide live commentary, trade alerts, education, and more every day in our discord room. Watch the video below to see inside our room before you consider joining! Join anytime here: https://discord.gg/4CXuRRzwHU