Pandas Weekly Newsletter 10/13/24

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

Market Big Picture & Long-Term Technicals

$SPX broke out of its consolidation and upward trend resistance last week with a close right near the 5818 target we’ve had for a few weeks. As long as price continues to hold outside 5800, we are targeting 5880. A break back below with strength from sellers under 5767 would start a larger dip to the bottom of this range near 5669 over the coming week(s). Core retail sales are this week along with earnings season kicking off.

Economic Calendar & Earnings

source: investing.com

Notable Earnings: C 0.00%↑ JNJ 0.00%↑ ASML 0.00%↑ MS 0.00%↑ TSM 0.00%↑ NFLX 0.00%↑ ISRG 0.00%↑ AXP 0.00%↑

Near Term Outlook & Trade Plan

SPX > 5822 targets 5880

SPX 5796 - 5822 = chop zone

SPX < 5796 targets 5767

Pandas Weekly Watchlist

Our Favorite Trade Setup - MDB over 300

Contract: MDB 10/18 310c

Levels: 308.38, 321.21, 347.18

Stop: 291.90

Notes: We saw some major rotation into software names at the end of last week and will be watching for continuation into this week. This name presents a nice setup with a major level being right near 300. If this level breaks its possible we can see a quick move to 308.38 level where there is a gap that has yet to be filled.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

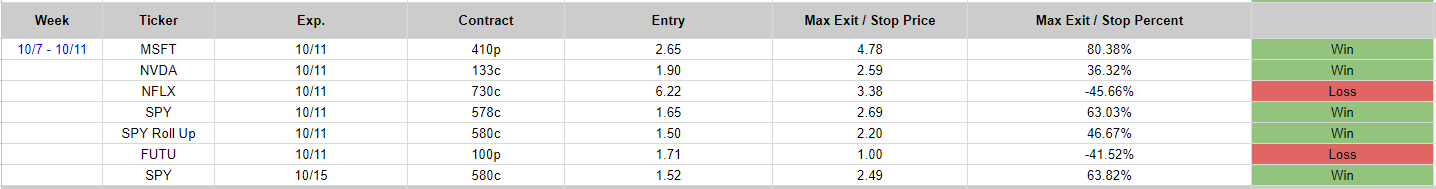

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.