Pandas Weekly Newsletter 10/20/24

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

Market Big Picture & Long-Term Technicals

$SPX broke higher last week out of its upper trendline. We’re entering a phase that could turn into a strong push higher into the end of the year. If we avoid a larger dip, we will likely see price speed up more aggressively toward 6000+. A healthy dip would be back to 5669 that would set up a healthier trend higher into end of year. Downside would begin to speed up and enter a corrective phase once we fail 5400.

Year end targets below. If the market avoid any major news or correction, our upside target is located just shy of 6272. In a larger corrective phase the downside target is 4800.

Upside: 6272

Downside: 4800

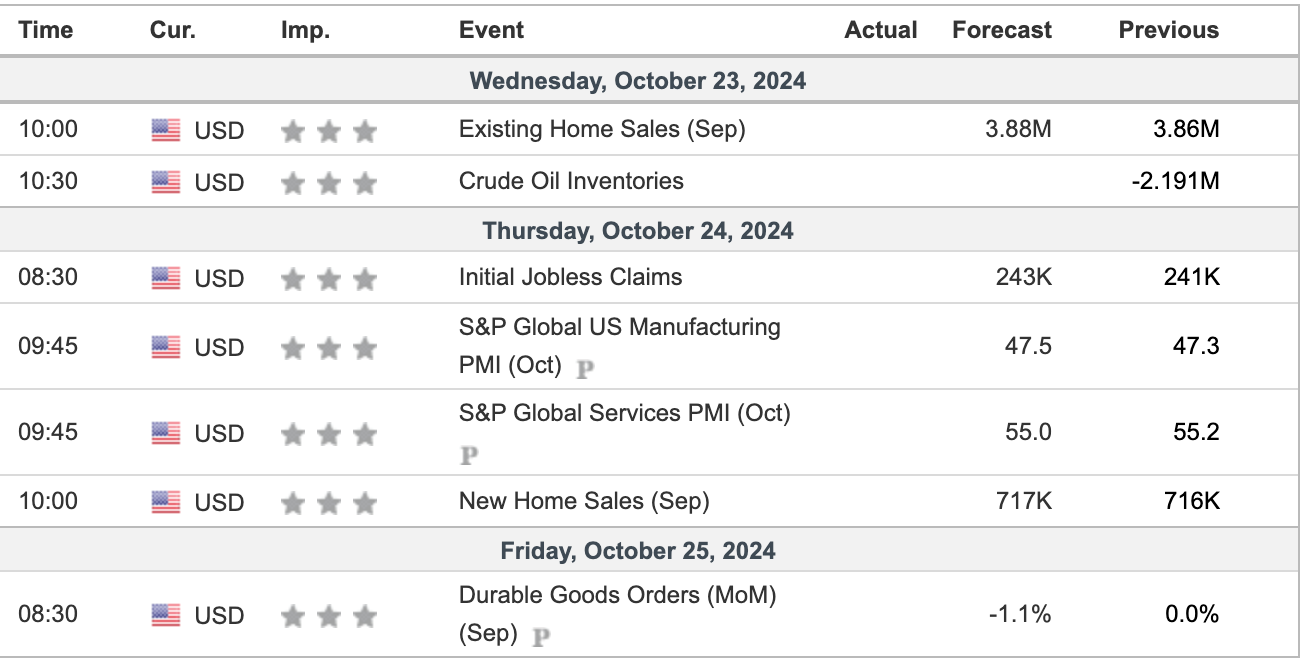

Economic Calendar & Earnings

source: investing.com

Notable Earnings: ENPH 0.00%↑ TSLA 0.00%↑ BA 0.00%↑ LRCX 0.00%↑

Near Term Outlook & Trade Plan

SPX > 5878 targets 5900

SPX 5822 - 5878 = chop zone

SPX < 5822 targets 5800, 5767

Pandas Weekly Watchlist

Our Favorite Trade Setup - NFLX over 766.28

Contract: NFLX 10/25 780c

Levels: 782.13, 800, 820

Stop: 753

Notes: Coming off a positive reaction to earnings last week that gapped over ATHs this will be a continuation play I’m watching this week. Entry will be using the highs from Friday and don’t have many levels on this one with the closest being a fibonacci level at 782.13 so will just be progressively locking gains along the way if they are there.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.