Pandas Weekly Newsletter 11/24/24

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

Market Big Picture & Long-Term Technicals

$SPX SPY 0.00%↑ held up 5850 support last week near the prior all time highs. We managed to see the market defend very well on dips and close the week on the highs. The first dips reaction since the most recent rally following the reaction was met well with buyers stepping in. We’re basing below the highs and can see the market trend toward the 6180 target next if we continue to hold over 5850. A sell below 5850 would trigger larger supports being tested at 5767-5700. At this stage the market would still be setup for the upside but take longer to unwind. Below 5700 will create a more corrective test for the market.

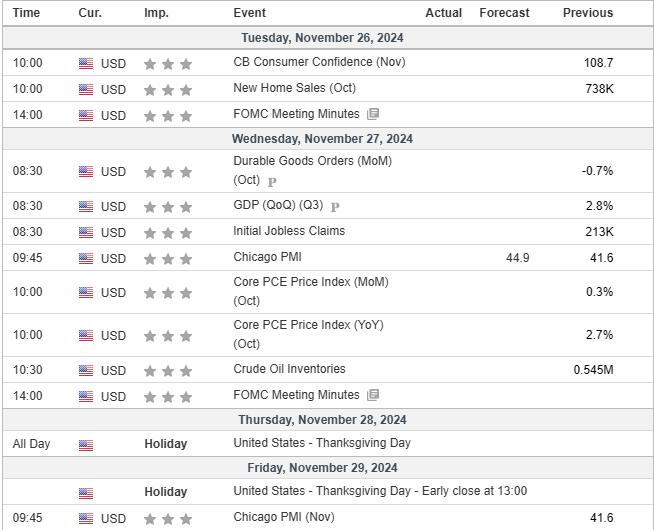

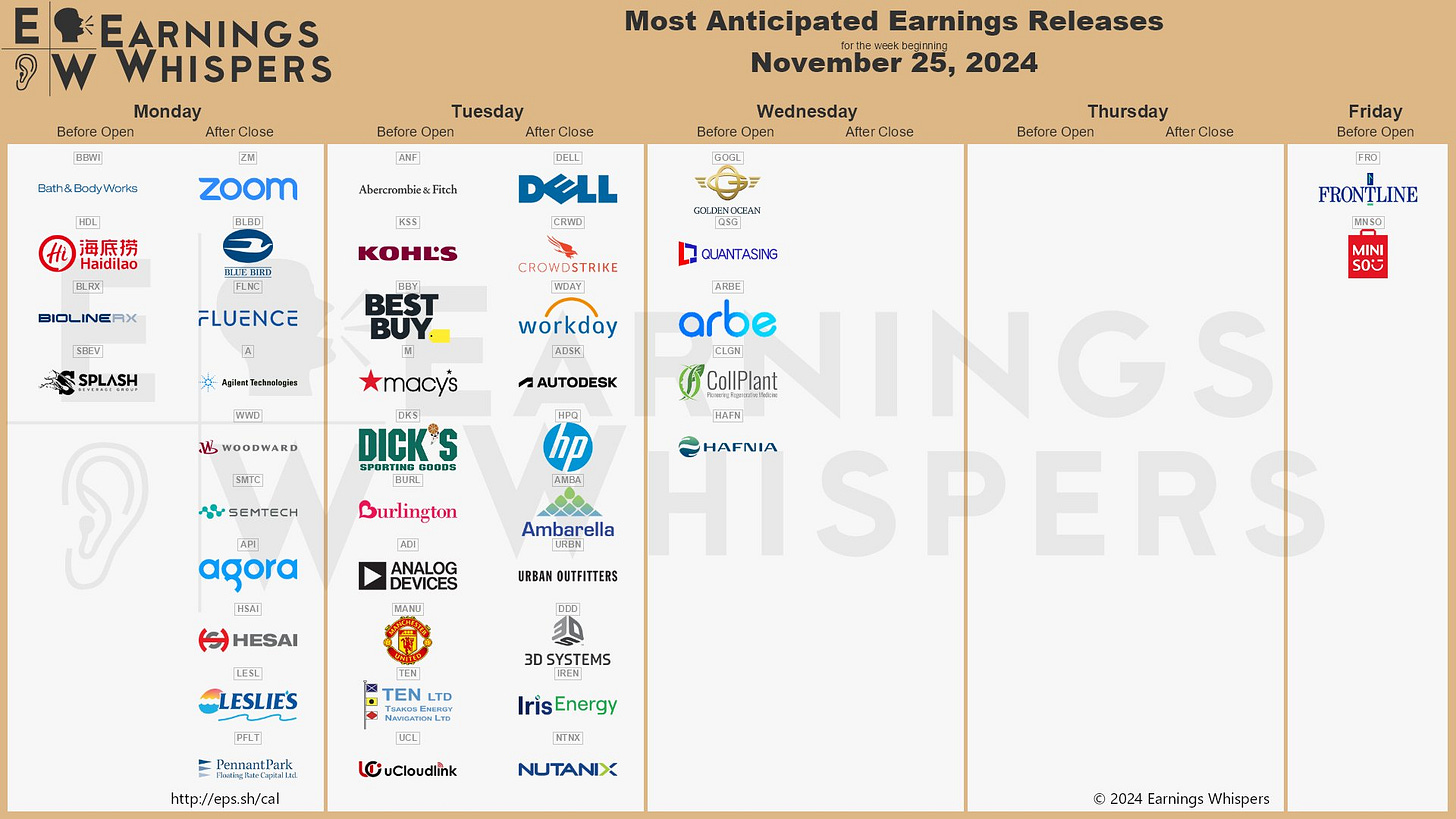

Economic Calendar & Earnings

source: investing.com

Notable Earnings: ZM 0.00%↑ ANF 0.00%↑ BBY 0.00%↑ DELL 0.00%↑ CRWD 0.00%↑ WDAY 0.00%↑

Near Term Outlook & Trade Plan

SPX > 5983 targets 6000, 6013

SPX 5915 - 5983 = chop zone

SPX < 5915 targets 5900, 5878

Pandas Weekly Watchlist

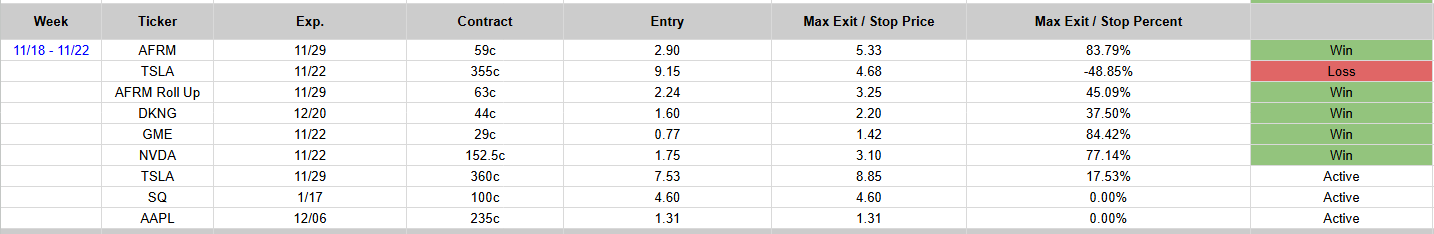

Our Favorite Trade Setup - TSLA over 356

Contract: TSLA 11/29 365c

Levels: 371.74, 400, 414.50

Stop: 344.30

Notes: This name ended last week with some nice momentum, and we will be watching it closely heading into this week to continue that momentum. Broke out of a tight short term pennant and over 356 (5min flag setup) we can see a push to 371.74, 400.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.