Pandas Weekly Newsletter 11/3/24

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

Market Big Picture & Long-Term Technicals

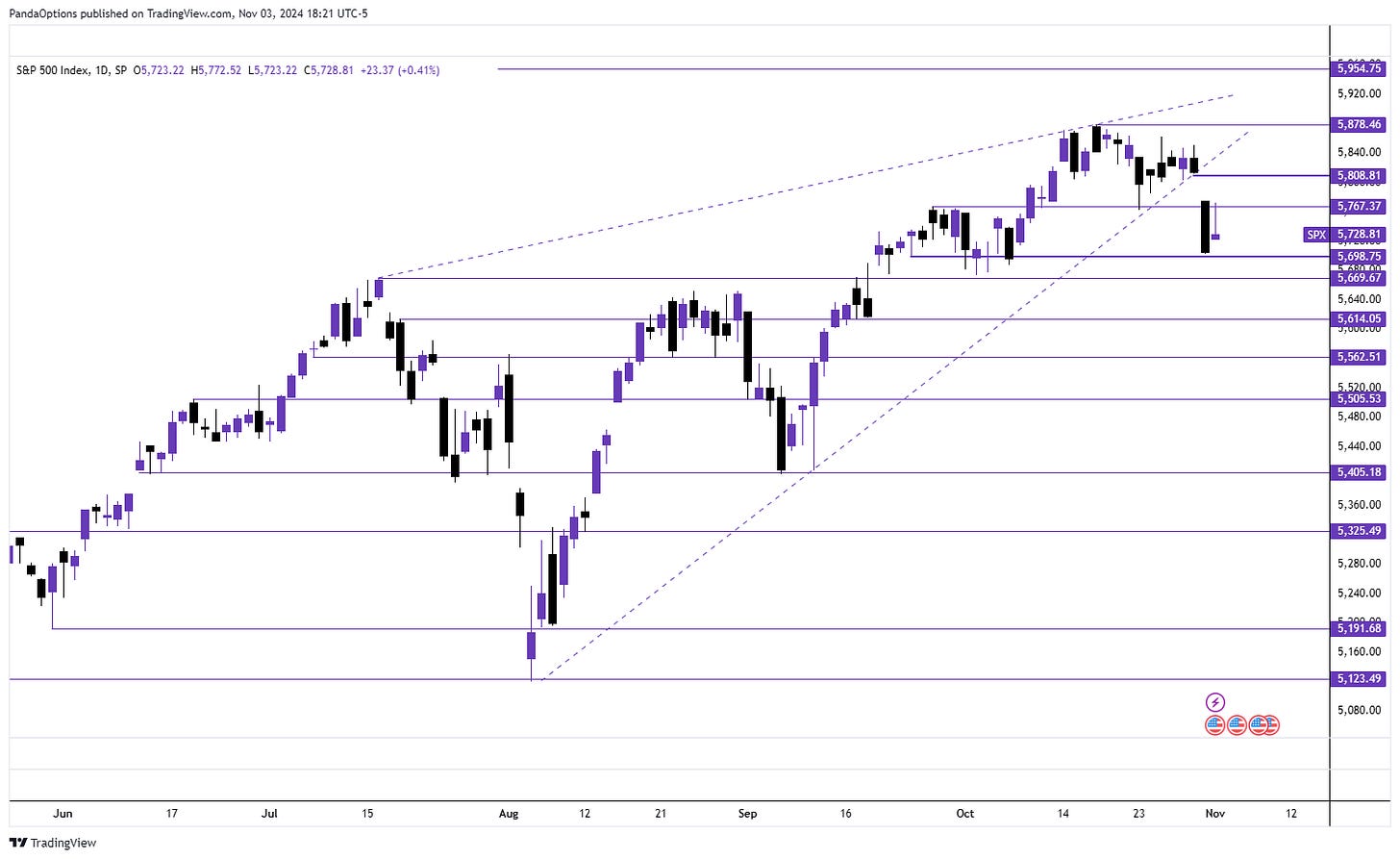

$SPX finally broke down out of its consolidation off the highs last week. Price managed to sell into 5700 support. This week has a large 150pt implied move with the election and FOMC coming. It’s important to remember to stay patient when known volatility is around the corner. If price stays below 5767 we can see another leg lower to 5600s. Back above 5800 sets up a strong breakout to 5900.

Economic Calendar & Earnings

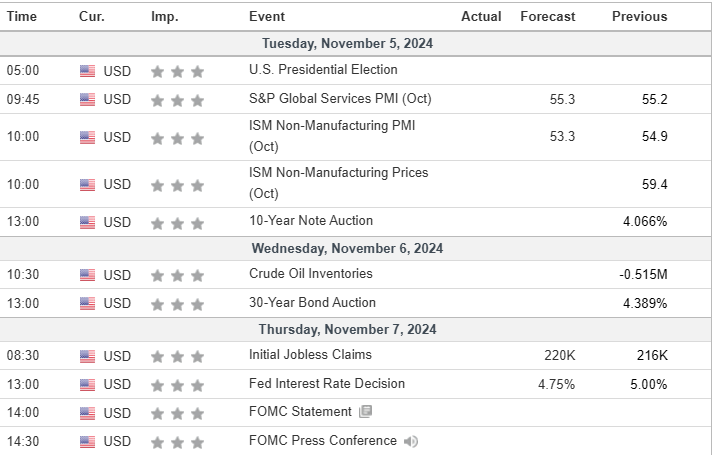

source: investing.com

Notable Earnings: PLTR 0.00%↑ ARM 0.00%↑ DKNG 0.00%↑ QCOM 0.00%↑ SQ 0.00%↑ DDOG 0.00%↑ RIVN 0.00%↑ AFRM 0.00%↑

Near Term Outlook & Trade Plan

SPX > 5767 targets 5800

SPX 5700 - 5767 = chop zone

SPX < 5700 targets 5669, 5614

Pandas Weekly Watchlist

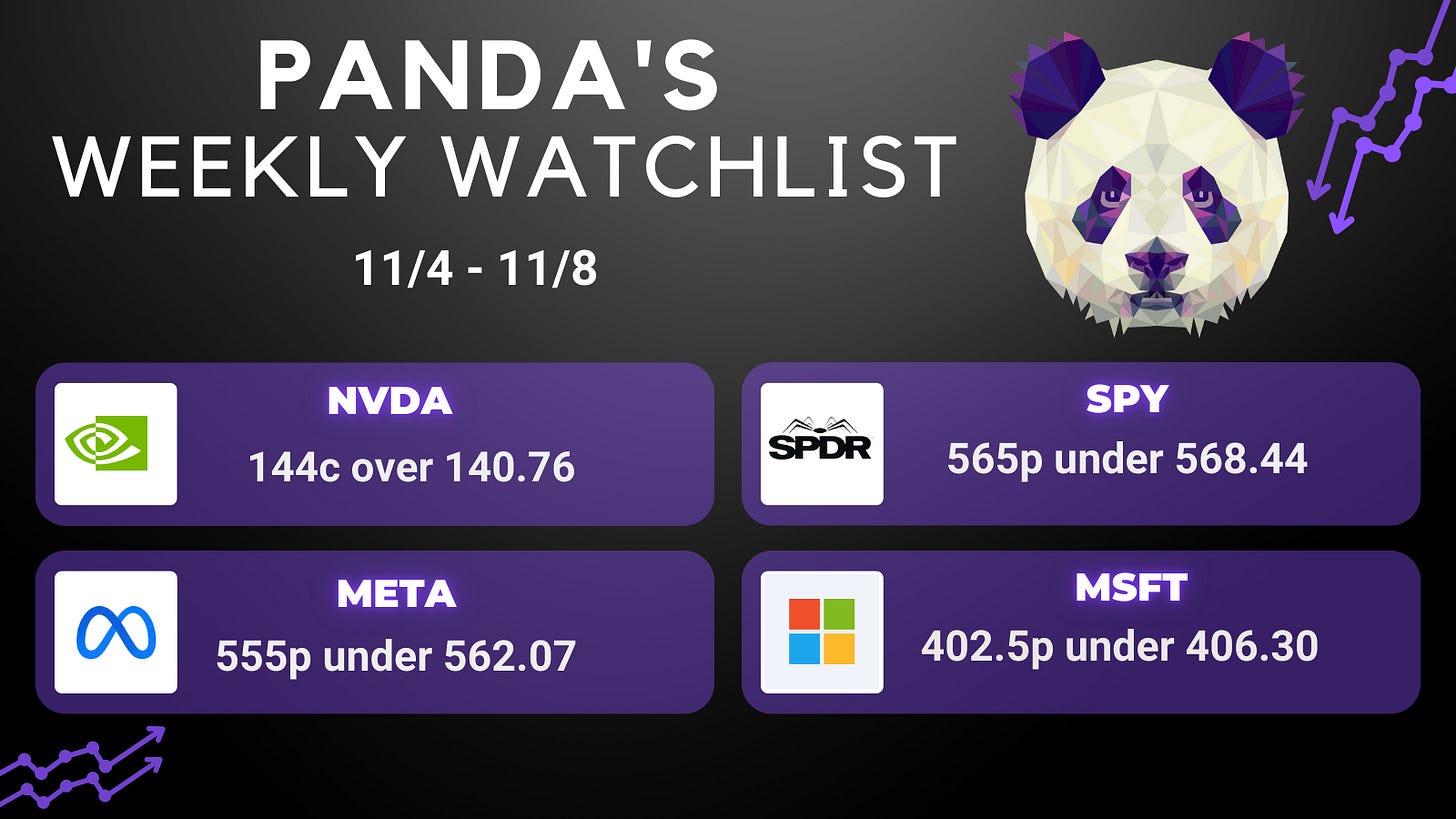

Our Favorite Trade Setup - SPY under 568.44

Contract: SPY 11/6 565p

Levels: 565.17, 560.61, 552.50

Stop: 572

Notes: Broke down under the major trendline last week. Several names broke their major trendlines but I like SPY 0.00%↑ to simplify. Friday followed up with a tight inside day. A break under the lows from Thursday gap down sets it up nicely for 565.17, 560.61.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.