Pandas Weekly Newsletter 12/1/24

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

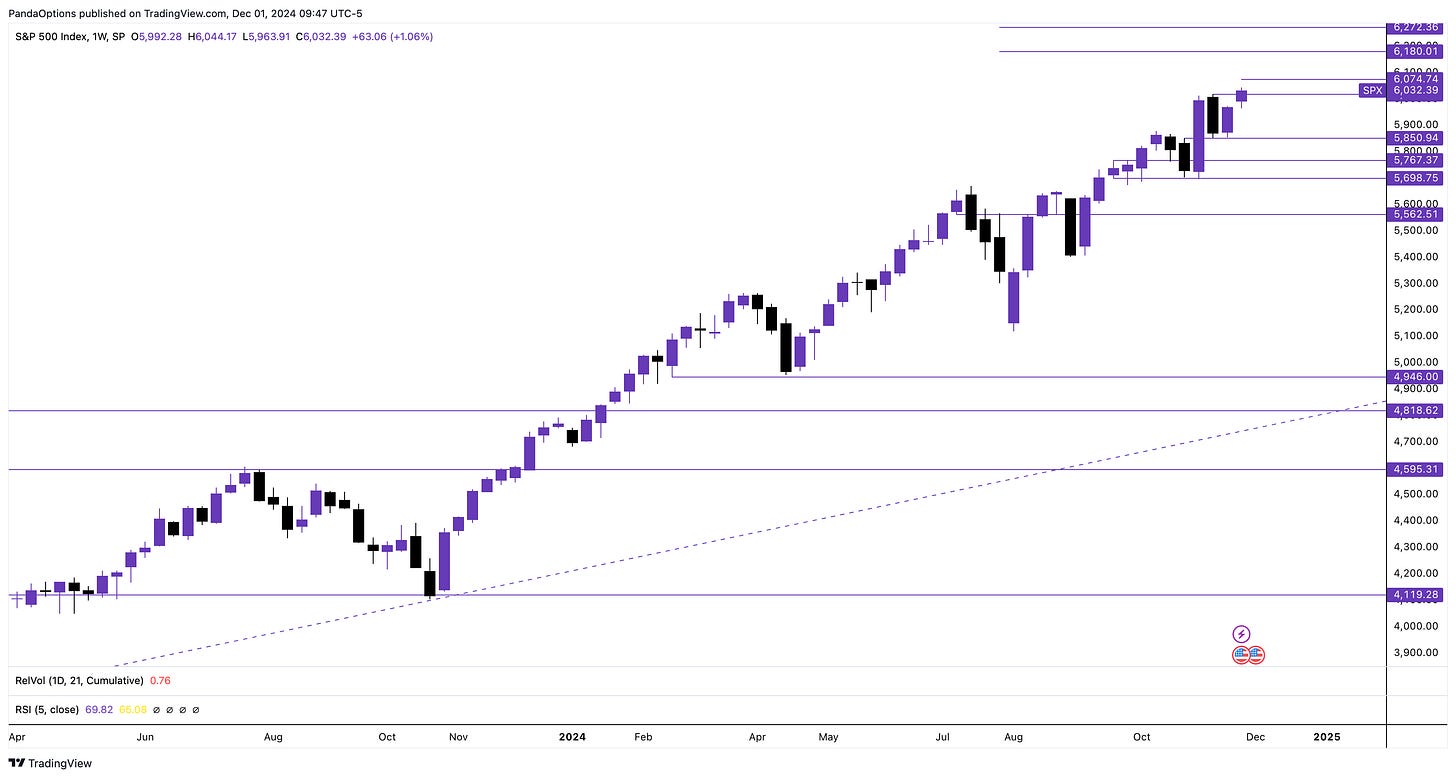

Market Big Picture & Long-Term Technicals

$SPX SPY 0.00%↑ held 6000 last week on dips and closed above for the short holiday week. If price can defend near the highs early this week, we can see a push to 6100. A quick dip below 6000 sets up another key test of support at 5983 and 5965. Once 5965 is lost the downside can pick up momentum.

Economic Calendar & Earnings

source: investing.com

Notable Earnings: ZS 0.00%↑ CRM 0.00%↑ OKTA 0.00%↑ CHWY 0.00%↑ FL 0.00%↑ DG 0.00%↑ ULTA 0.00%↑ DOCU 0.00%↑

Near Term Outlook & Trade Plan

SPX > 6044 targets 6074

SPX 6000 - 6044 = chop zone

SPX < 6000 targets 5983, 5965

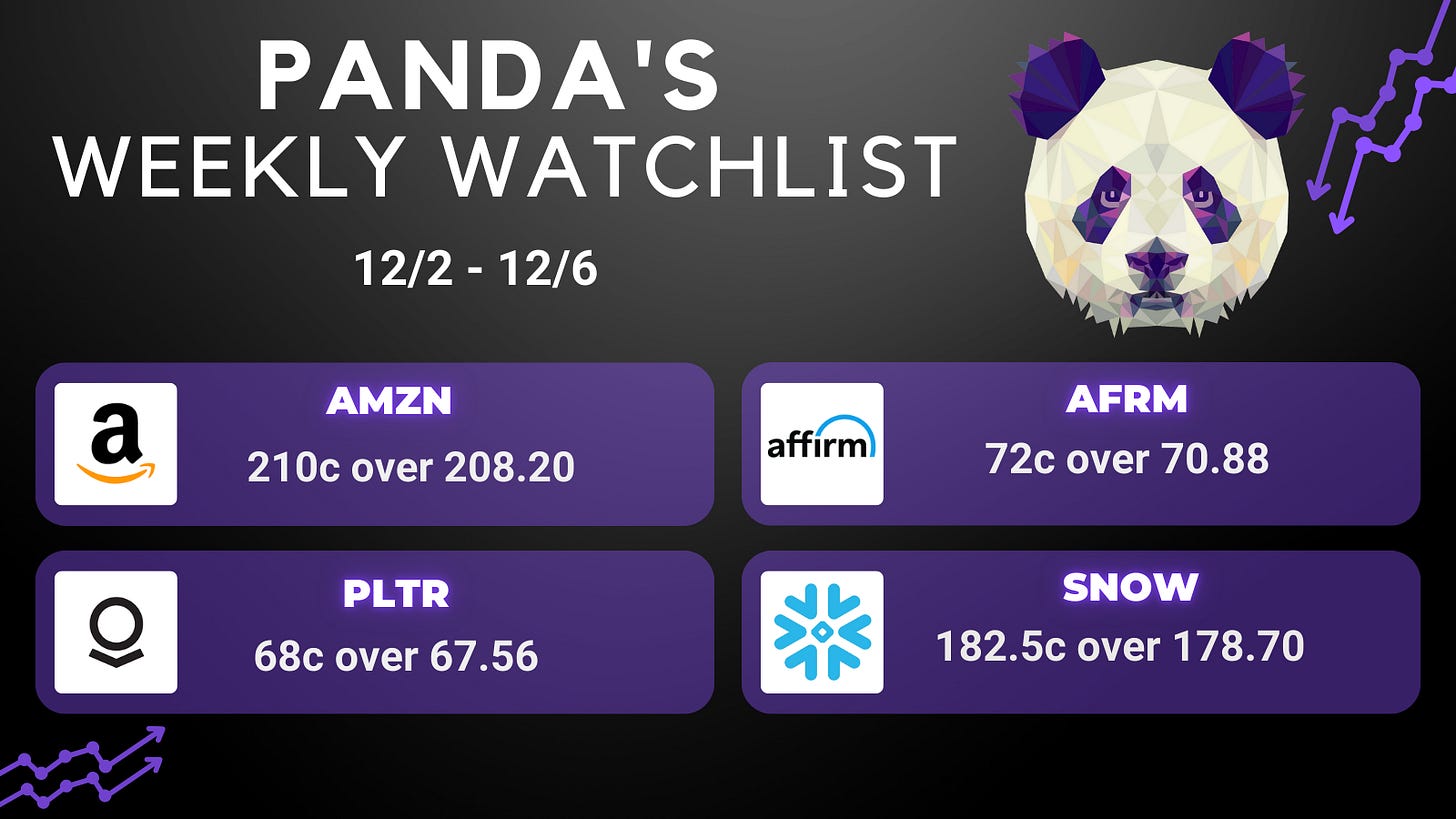

Pandas Weekly Watchlist

Our Favorite Trade Setup - AMZN over 208.20

Contract: AMZN 12/6 210c

Levels: 210.05, 212.25, 216.76

Stop: 205.20

Notes: Breaking out of a period of digestion after making new ATHs sets this name back up for another potential push to ATHs. Using the break of highs from Friday as an entry and just under support for a stop.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

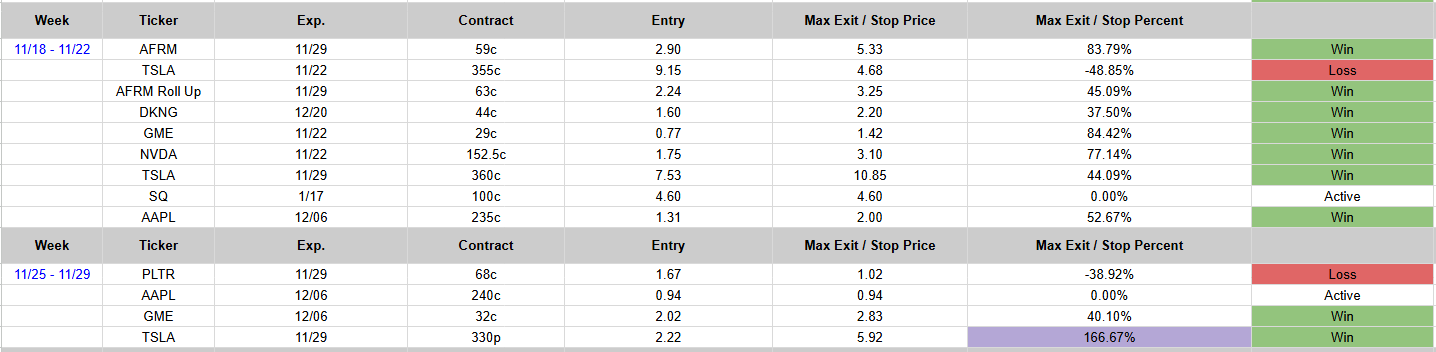

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.