Pandas Weekly Newsletter 12/29/24

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

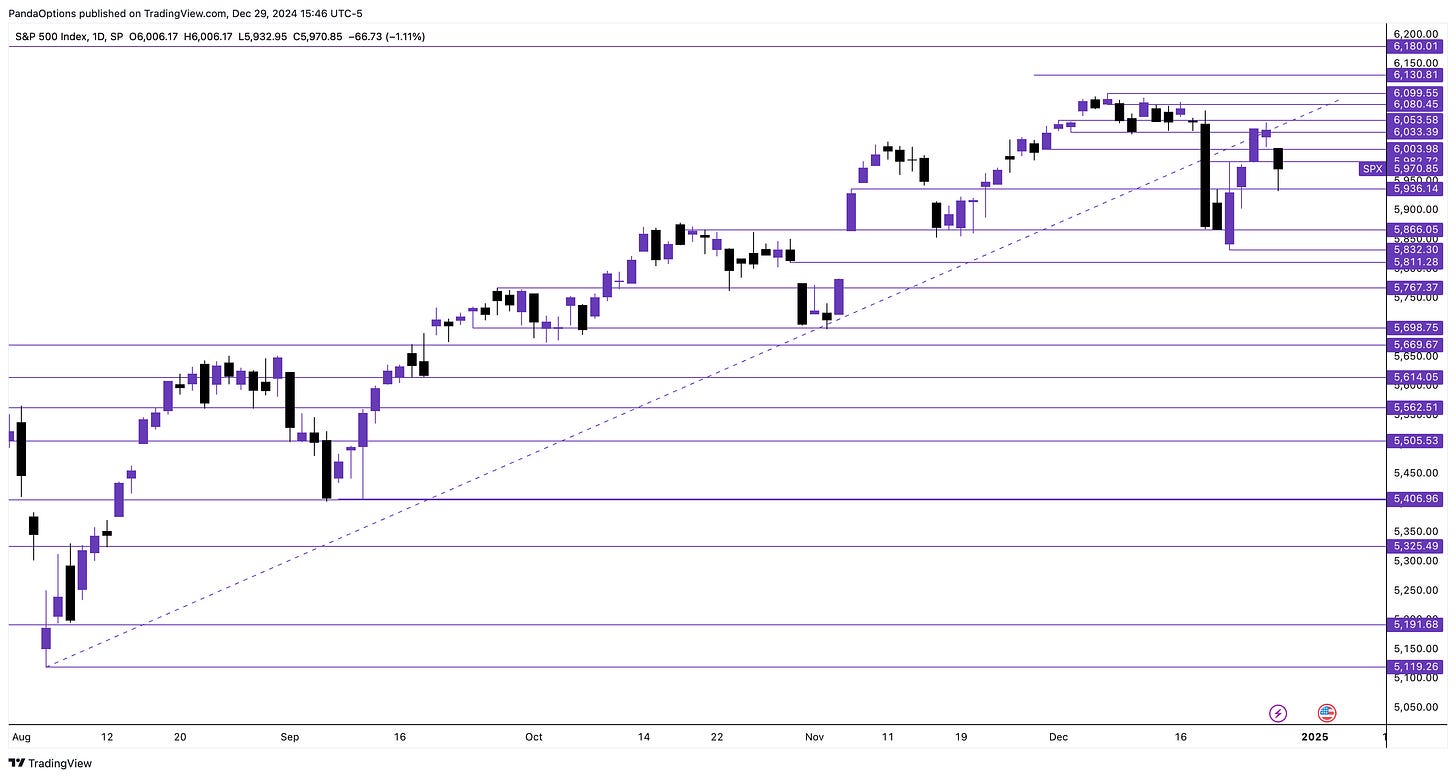

Market Big Picture & Long-Term Technicals

SPY 0.00%↑ / SPX closed at 5970.85. The market has continued to be in play with large ranges. On Friday the market rejected the backtest of the larger daily trend creating a sell off into 5936. We had a strong reaction there with the only real bounce of the day leading into the close. If 5936 fails, we can fade to 5900 and see volatility pick back up. Back over 6000 is need for longs to look better near term. The end of year / start of year flow should create some larger moves for us to trade. There is about a 100pt implied move for the short week ahead. Focusing on the overall market can be a good way to simplify this week.

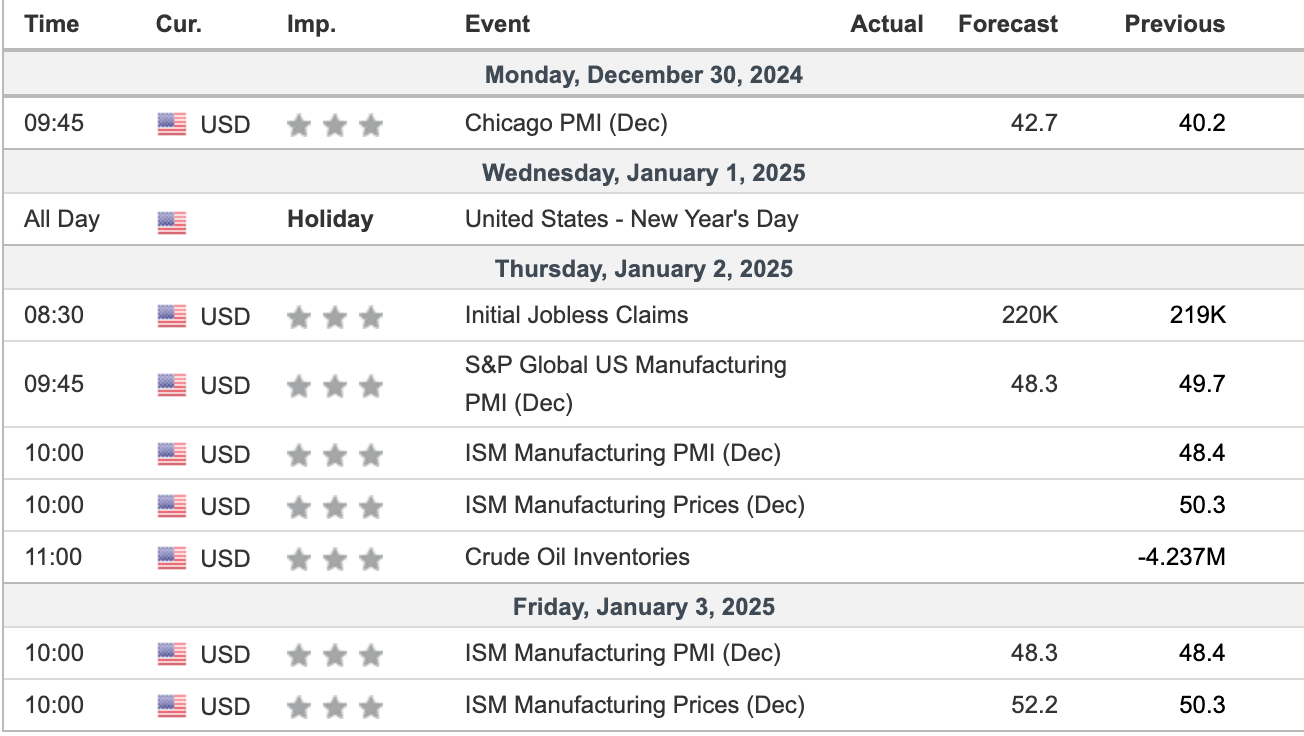

Economic Calendar & Earnings

source: investing.com

Notable Earnings: there are no earnings reports until next year.

Near Term Outlook & Trade Plan

SPX > 6008 targets 6052

SPX 5936 - 6008 = chop zone

SPX < 5936 targets 5900, 5866

Pandas Weekly Watchlist

Our Favorite Trade Setup - AVGO over 247.28

Contract: AVGO 1/3 260c

Levels: 251.21, 260, 270.76

Stop: 239

Notes: Relative strength has been apparent here and over 247.28 looks set up for a retest of the highs at 251.21. Coming off of the holiday week, which is typically a lower volume week, its important to focus on the names with edge and this one has been in play for us for several weeks now.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

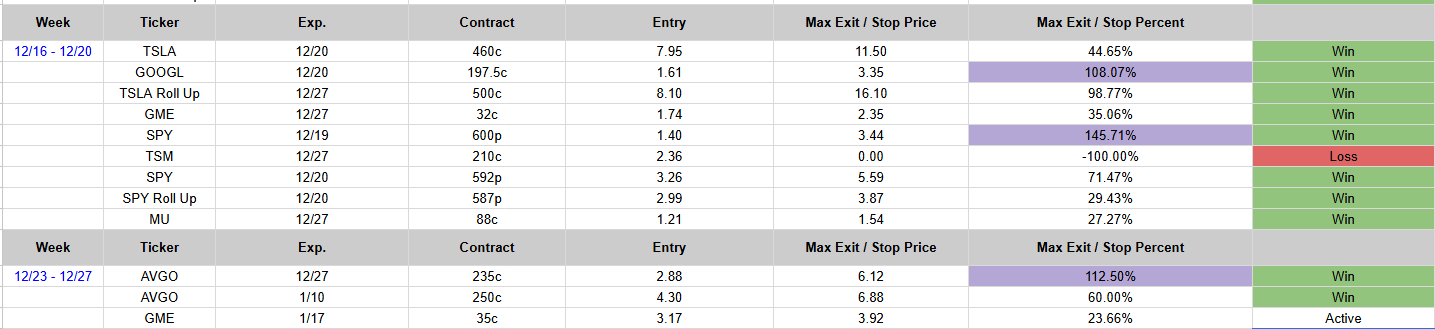

Want to review our performance first? Here was last weeks performance along with a link to the entire years worth of alert data.