Pandas Weekly Newsletter 2/2/25

Every week we review everything you need to know about the stock market for the week ahead as an active or passive trader.

Market Big Picture & Long-Term Technicals

SPY 0.00%↑ / $SPX closed lower last week after putting in a lower high from the previous all time highs at 6128. We saw the impact of uncertainty surrounding tariffs last week as we closed out the first month of the year. Tomorrow starts the first trading in February which traditioanally can be more volatile. With added uncertainty and a bsuy week of earnings + economic data, it will likely be a traders market with several opportunities to capitalize in both directions. 6017 remains a near term pivot in the market with overhead resistance at 6100-6138.

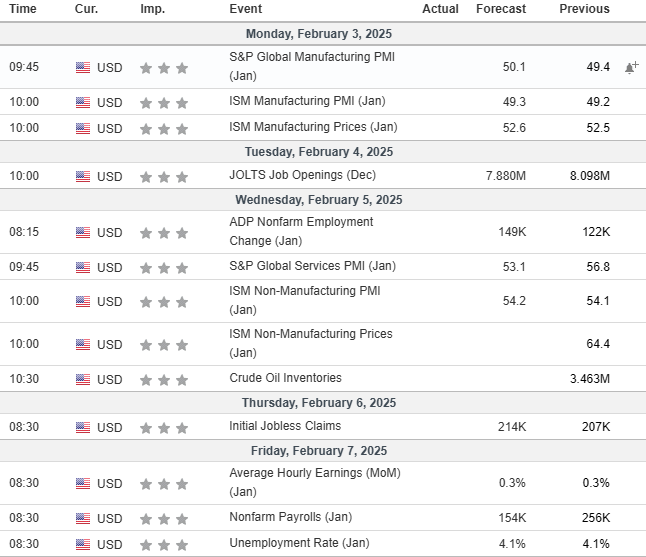

Economic Calendar & Earnings

source: investing.com

Notable Earnings: PLTR 0.00%↑ PYPL 0.00%↑ AMD 0.00%↑ GOOGL 0.00%↑ CMG 0.00%↑ ARM 0.00%↑ AMZN 0.00%↑

Near Term Outlook & Trade Plan

SPX > 6076 targets 6100, 6128

SPX 6017 - 6076 = chop zone

SPX < 6017 targets 6000, 5964

Pandas Weekly Watchlist

Our Favorite Trade Setup - MSFT under 413.16

Contract: MSFT 2/7 407.5p

Levels: 408.37, 400, 396.50

Stop: 417.50

Notes: Negative reaction to earnings last week followed by the overall market selling off a bit. If market continues to drop into this week, we will be watching this name closely to lead under last weeks lows. Recent trend break paired with recent earnings report make this a top opportunity.

Join Our Professional Community!

We provide live commentary, trade alerts, education, and more every day in our discord room! Join risk free anytime here: https://whop.com/panda-options

Want to review our performance first? Here is our last few weeks performance along with a link to the entire years worth of alert data.